Girls learn how to have fun – and funds – by investing

30. 1. 2023

9 min.

Writer

When it comes to money, we know that men and women aren’t equal. The gender pay gap shows that women earn less than men, even when they are doing the same job, and the gender wealth gap shows that globally men have 50% more wealth than women. The disparity is clear when it comes to investing too. About 34% of women – and just 24% of men – don’t invest. That’s because they don’t know enough about it (40%) or they are afraid they will lose money (36%).

Frustrated with the lack of women in the finance industry, Anna-Sophie Hartvigsen, Emma Bitz, and Camilla Falkenberg founded Female Invest in their native Denmark in 2017. The startup has since become Europe’s largest financial education platform for women, offering events, masterclasses, and e-learning resources with the aim of bringing more women into the field. Above all, the platform has provided thousands of women with a space where they can learn about an industry they’ve been excluded from routinely.

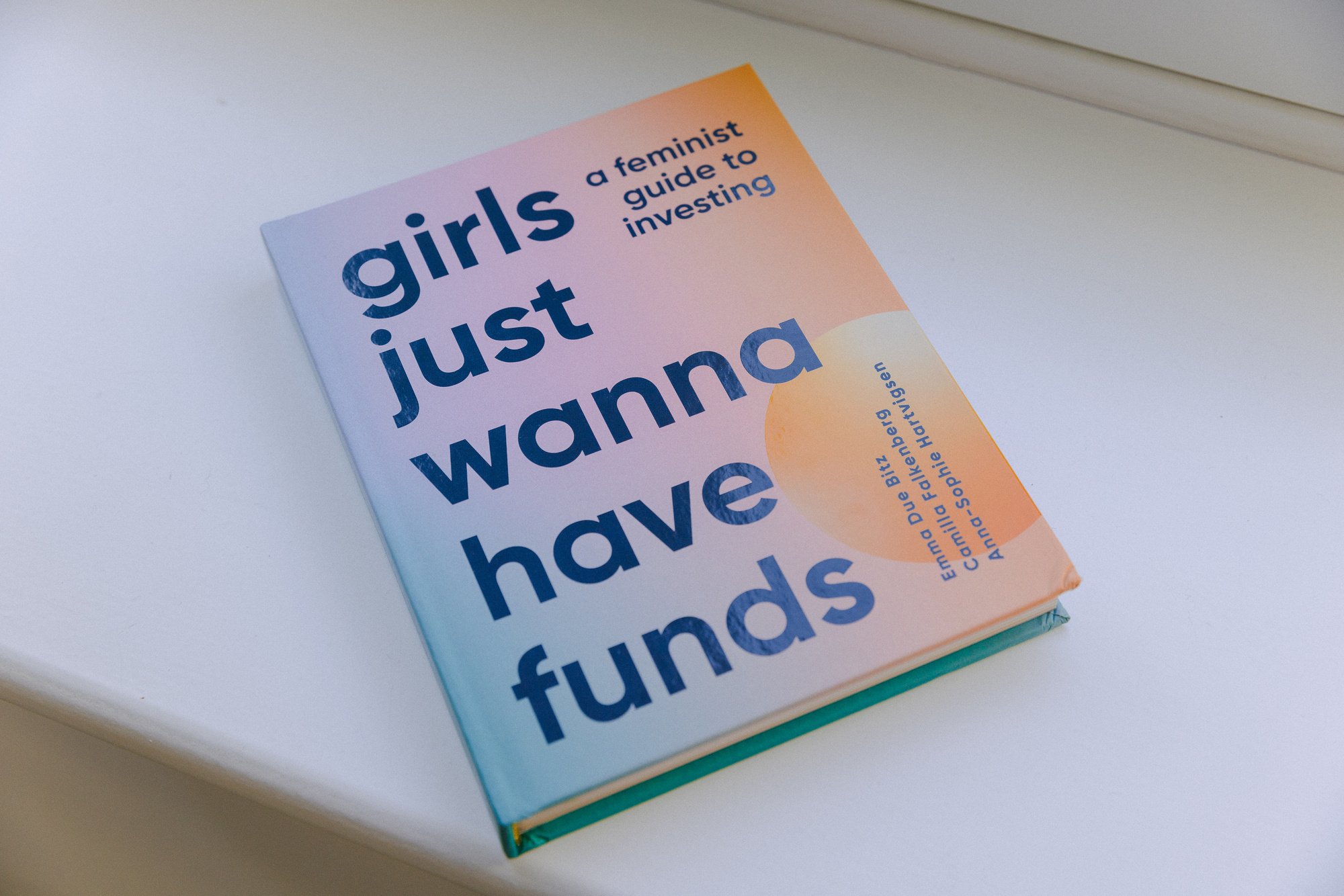

Over the past five years, the three founders have attracted a global community of women, raised millions of dollars in funding, and been named in the Forbes 30 Under 30 list. And they’re not stopping there. Last year Female Invest announced it was preparing to launch its very own trading platform dedicated to women, and their brilliantly-titled book, ‘Girls Just Wanna Have Funds: A Feminist Guide to Investing’ was published in December with tips on safe and sustainable investing.

The Jungle caught up with co-founder Anna-Sophie Hartvigsen to talk about the journey that has brought Female Invest to this point and to get advice for women who are thinking about investing but are not sure where to start.

When did you discover investing?

Because I come from a background where nobody really talks about money or investing, I had to do everything alone, which is very difficult. I started out super practical, googling “What are stocks?” and “Where do you trade stocks?” I started talking to people and asking about whether they invested and getting their advice. I read books on the topic and really just educated myself from scratch. Within the first year of doing that, I made my first investment and it quickly started going pretty well. Then one thing led to another and, as I became more and more advanced in investing, I realized how few women were in the space. It was really lonely for me not really having anyone to talk to about investing. I did some research and realized that this was a global problem.

What are the systemic issues underpinning gender inequality in finance?

I would say there are two big systemic issues keeping women from investing. The first is stereotyping. There are so many stereotypes around women and money. Even though we’ve come far in many ways, there is still this perception that the man is the breadwinner and money is a masculine thing. So much research has been done on this topic and it shows that from a young age, girls are taught about money differently from boys. Girls receive less pocket money and are expected to do more household chores. Then, as we go through life we get paid less, starting with student jobs and internships. When women go to a bank they receive different advice than men: it’s more focused on saving than on investing. When they take out mortgages, women get worse terms. This is systemically proven as well. So that’s one thing. Secondly, there is a lack of representation. The financial industry, the way it is today, is built by and for men, and this is reflected in every single aspect of it, from the people who run it to the products that are being made. Communication is just not made with women in mind. As a result, a lot of women don’t engage with it and then it’s mistakenly perceived as though women aren’t interested or aren’t talented when it comes to investing. But it’s just because nothing is made for them to engage with in the first place.

Why is it important to get more women to start investing?

It’s very important to understand that investing is not just about having an interest in finance or wanting a side hustle. Investment is about money and it’s about power. Every woman should invest because every woman should have the freedom to make their own decisions and not be dependent on anyone or anything. So that’s why investing is so important. We talk a lot about the gender pay gap, which unfortunately we cannot impact ourselves, but we don’t talk enough about the gender investment gap, which we can impact ourselves by starting to invest today. During the course of a lifetime, how you manage money matters more than how much money you make in the first place. That’s why it’s important.

In the book, you say things aren’t improving in terms of financial equality, but they’re getting worse

We’re talking more about gender equality in all areas than we ever have before. Everyone is fed up with talking about it, including women. We just want it to happen. So even though we talk so much about it, not that much progress is happening. And this is especially apparent when it comes to money, which is very easy to measure. We see that the wealth gap is increasing, especially since Covid-19. Financial crises always hit women harder. And we also see that in many areas of society; not much change is happening.

You mention in your book that it will take a long time to close the financial gender gap.

That’s [according to] the World Economic Forum [In July 2022, it said it would take 132 years to close the gap]. We often hear this narrative that it’s the next generation of women who will claim power. We have an educated generation and everything will change when the boomers are out and Gen Z takes over. But that is not the case, and people tend to forget that women have been educated and capable and interested for generations, but it still hasn’t made a difference. So I think this narrative has become an excuse to not do anything because the problem will solve itself. But actually, it won’t, and the numbers show that very clearly.

You founded Female Invest in 2017 as a platform to educate women about finance and investing. What have you learnt in five years of teaching women how to invest?

A lot. I’ve learnt first and foremost that women are massively interested in investing and money management, and that the women who are interested are not just highly educated women like bankers or lawyers. It’s women across all layers of society because obviously, all women want freedom and independence. I’ve learnt that there is a massive willingness but it’s just not addressed, and that makes it look like there is none. I’ve also learnt something that the numbers also show over and over again, which is that women are very good at investing. In fact, women outperform men – both among private investors and professional ones – when they invest.

Why do women outperform men? Can you explain that?

When we look at the trends of how the two genders invest, we see that women tend to hold their investments for a longer period of time and that they tend to take on a little bit less risk. We tend to shame that and make it sound like women don’t dare to take risks, but actually, this is a winning strategy. Men tend to be more confident and believe that they can beat the market and therefore they trade much more frequently. But as we all know, you cannot beat the market, and that just means they get worse returns over time. This is, of course, very generalized but those are the trends that we see.

Investment comes with risk, which is probably why many women shy away from it. Do you find that first-time female investors are too cautious when they start out?

Women are already overly cautious because that’s what we are taught throughout our entire lives. We are taught to save money, not take risks but to play it safe. So that part we’ve definitely got down because everyone has been telling us to do it our entire lives. Now it’s time to get women out of their comfort zone and make them realize that money is a topic that is relevant to them, that they can be interested in, and that they need to engage with in order to decide their future. A woman told me yesterday that she was never interested in finance and business because whenever she saw her husband reading books or magazines about it there were always white, old men on the cover and the language was boring and dry. But now, after she read our book, she realized that she’s actually very interested in the topic, she just never had something that was written by someone who looked like her.

How has the pandemic affected how people invest? Are there greater risks today?

We get a lot of questions about this and I always say that the stock market has existed for over 400 years and, during that time, there have been countless crises along the way. There has been war, natural disaster, and unprecedented events changing the world. We’ve had pandemics before such as the Spanish flu. So even though it feels like we’re living in unprecedented times now, it’s actually quite normal for the economy and the stock market to go through different stages. We previously had a long period of time during which the economy was doing very well, so it’s natural for there to be a dip. It’s not the first time we’re seeing it and it won’t be the last either. But I don’t think anything has changed fundamentally, it’s just a new stage of the cycle and it’s perfectly normal.

Should people be concerned about investing now?

I can’t predict the future but I can say that historically times of crisis like now have been by far the best time to begin investing because prices are low, so I don’t think women should be concerned, they just need to be wise in how they do it. We always advise that you should never invest all of your money at once but instead spread it out. This is called “dollar cost averaging,” and we just call it “investing gradually” as well. You invest a little bit every month or every second month, because that way you get a nice average price over time. So I think now can be a very good time to begin investing.

What about cryptocurrencies? Is it something you have seen female first-time investors going for?

I would say crypto is riskier but, unfortunately, it has got a lot of exposure on social media and in the media in general, which has meant that unfortunately a lot of new investors who don’t understand anything about it invest in it. Crypto is an interesting phenomenon and it doesn’t mean you shouldn’t invest in it, but it should be a small part of your portfolio, something like 5% maybe. Even though it sounds exciting and we hear stories of people making millions from nothing, when a story sounds too good to be true it’s because it is.

What key piece of advice can you give to people to protect themselves as investors?

The first thing is diversification. Investing is not about picking the next Apple because you won’t be able to do that, so play the long game and diversify, and then just be reasonable. If something sounds too good to be true then it probably is. If someone reaches out and says that you have inherited £10 million, or someone tells you you can be a millionaire by investing £10 in crypto, then it’s probably not true. Just be realistic and down to earth, and then remember to stick with facts, because when it comes to investing there are so many people trying to sell you different things. The best way to go is to diversify and have a long-term plan.

What kind of advice would you give to women who find the idea of investing too daunting?

They should remember that the most important step they take is the first step. Because we are taught to be so overly cautious, a lot of women postpone that first step for months or years, or even their entire lives. It’s not about being perfect, it’s just about remembering the basics of the stock market which is that historically it has always increased in the long run if you have diversified. It’s as simple as it sounds. So just remember the basics and then dare to take the leap even though you don’t know everything.

How small can one’s first investment be?

That depends on the trading platform you use and what the fees are. As a rule of thumb, the fees should never make up more than half of one month’s investment. When you check the fees, remember that all trading platforms are businesses as well, so they need to make money. Even though some platforms advertise that you can trade for free, it’s never really the case. There are always fees but they may be hidden in the price you pay for a stock or somewhere else. Find a platform that clearly states how they make money so you know what you’re paying and, if it’s hard to find out, move to something else.

You say the best-kept secret of the stock market is that you don’t need to know much about it in order to start investing. How much do people need to know before they invest?

Fairly little, actually. You need to understand what stocks are, just a basic understanding, and how the stock market works. And then you need to understand that as a new investor it’s just about diversifying and then keeping your hands off the keyboard. That’s it. I also think that when it comes to investing a lot of learning is done by doing. This is something I see in many of our members. They study it for a long time but actually, they learn a lot more by just making their first investment. Putting in a small amount and seeing how it goes. I think that’s a good way of going about it.

Photo: Betty Zapata for Welcome to the Jungle

Follow Welcome to the Jungle on Facebook, LinkedIn, and Instagram, and subscribe to our newsletter to get our latest articles every day!

Další inspirace: Inspirativní příběhy

Be real, get ahead: The power of authenticity in your career

Pabel Martinez shares insights on how to allow yourself to be yourself, find your voice, and deconstruct stereotypes at work.

25. 4. 2024

The professionalism paradox: Navigating bias and authenticity with Pabel Martinez

Pabel Martinez challenges the conventional norms of professionalism by unraveling the complexities of workplace discrimination.

11. 3. 2024

How play can make you happy, creative and productive at work

Work-life balance usually means separating work and play, but it might be a better marriage than you think...

07. 11. 2023

Project Street Vet: Caring for the unseen paws of Skid Row

Providing vet-to-pet care in some of California's largest homeless communities, Dr. Kwane Stewart shares the ups and downs of his remarkable work.

29. 8. 2023

A conversation with Ted Conover, master of immersive journalism

We spoke to America’s reigning master of immersion reporting about political polarization, social media and how to hack it as a writer today

26. 1. 2023

Zpravodaj, který stojí za to

Chcete držet krok s nejnovějšími články? Dvakrát týdně můžete do své poštovní schránky dostávat zajímavé příběhy, nabídky na práce a další tipy.

Hledáte svou další pracovní příležitost?

Více než 200 000 kandidátů našlo práci s Welcome to the Jungle

Prozkoumat pracovní místa